Fintechs: key in enabling financial inclusion and economic growth in MENA

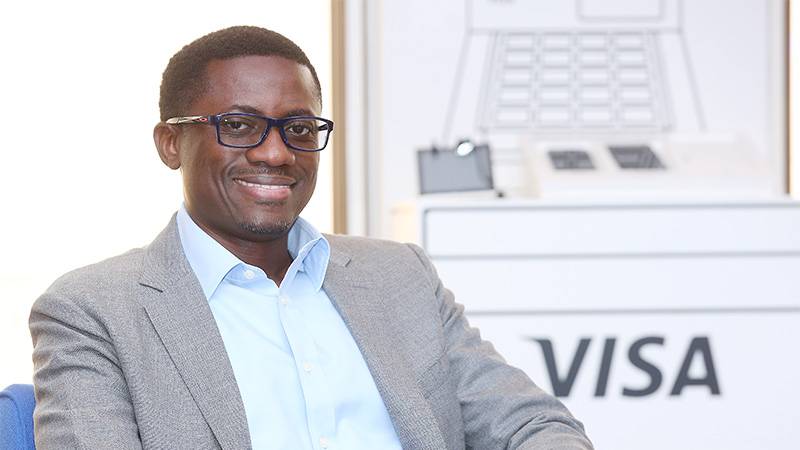

Otto Williams, Visa's Senior Vice President, Head of Product and Solutions - CEMEA, was a keynote speaker at the inauguaral Arab Fintech Forum held recently in Qatar.

As economies continue to struggle, expanding merchant access to the digital economy through payment acceptance and driving financial inclusion for those in need is more crucial than ever. One of Visa's top priorities is helping small businesses keep pace and adapt in a rapidly evolving world, recognizing that sustainable economic recovery depends on small businesses being able to "return to normal" and grow.

Empowering small businesses is also a key element of driving financial inclusion, which is crucial in reigniting the global economy in a post-pandemic world. With two billion unbanked people worldwide and 200 million micro and small businesses that lack access to financial services, streamlining the digitization of cash, enabling contactless payments and innovating new payment solutions have become crucial as we seek to drive financial inclusion for those in need. And this is where fintechs have an important role to play.

Fintechs are bridging the gap between those who have access to financial services and those who don’t. Their innovations can help propel the payments industry forward and expand access to quality, affordable financial services.

A full recording of Otto's presentation is available below. Watch it to learn about how Visa is partnering with many fintechs in MENA in creating new payment flows across digital and physical experiences.